NAMERA - WADI RUM

In the heart of Wadi Rum, Namra elevates the desert into a stage of global significance. This development reimagines the landscape with bold infrastructure, refined luxury, and transformative experiences that set a new benchmark for desert destinations worldwide.

-

To transform the desert of southern Jordan into a globally recognized destination brand — a symbol of modern luxury, cultural authenticity, and creative innovation that stands apart from Wadi Rum and becomes a name of its own: Namera.

-

To develop a cluster of world-class projects — luxury resorts, wellness retreats, cultural hubs, and lifestyle experiences — united under one identity. Each initiative carries its own character, but together they create a branded ecosystem that redefines tourism, anchors investment, and elevates Jordan as a frontier of global luxury travel.

-

• Heritage Valorization – respecting Nabataean, Arab, and desert cultural legacies while reinventing them for a new era.

• Market Diversification – serving multiple luxury tiers (from cultural lifestyle to ultra-luxury) within one cluster.

• Global Positioning – establishing Namera as a brand recognized alongside global luxury destinations.

• Sustainable Prosperity – embedding long-term economic benefit for investors and the region.

• Innovation & Experience – pioneering creative formats in design, events, and experiential tourism.

• Environmental Stewardship – building with responsibility to the desert’s fragile ecosystem.

• Integrated Infrastructure – developing transportation, services, and utilities that serve the whole cluster, not isolated projects.

• Investment Platform – offering investors not a single resort, but a portfolio ecosystem with scalable returns.

What is Namera?

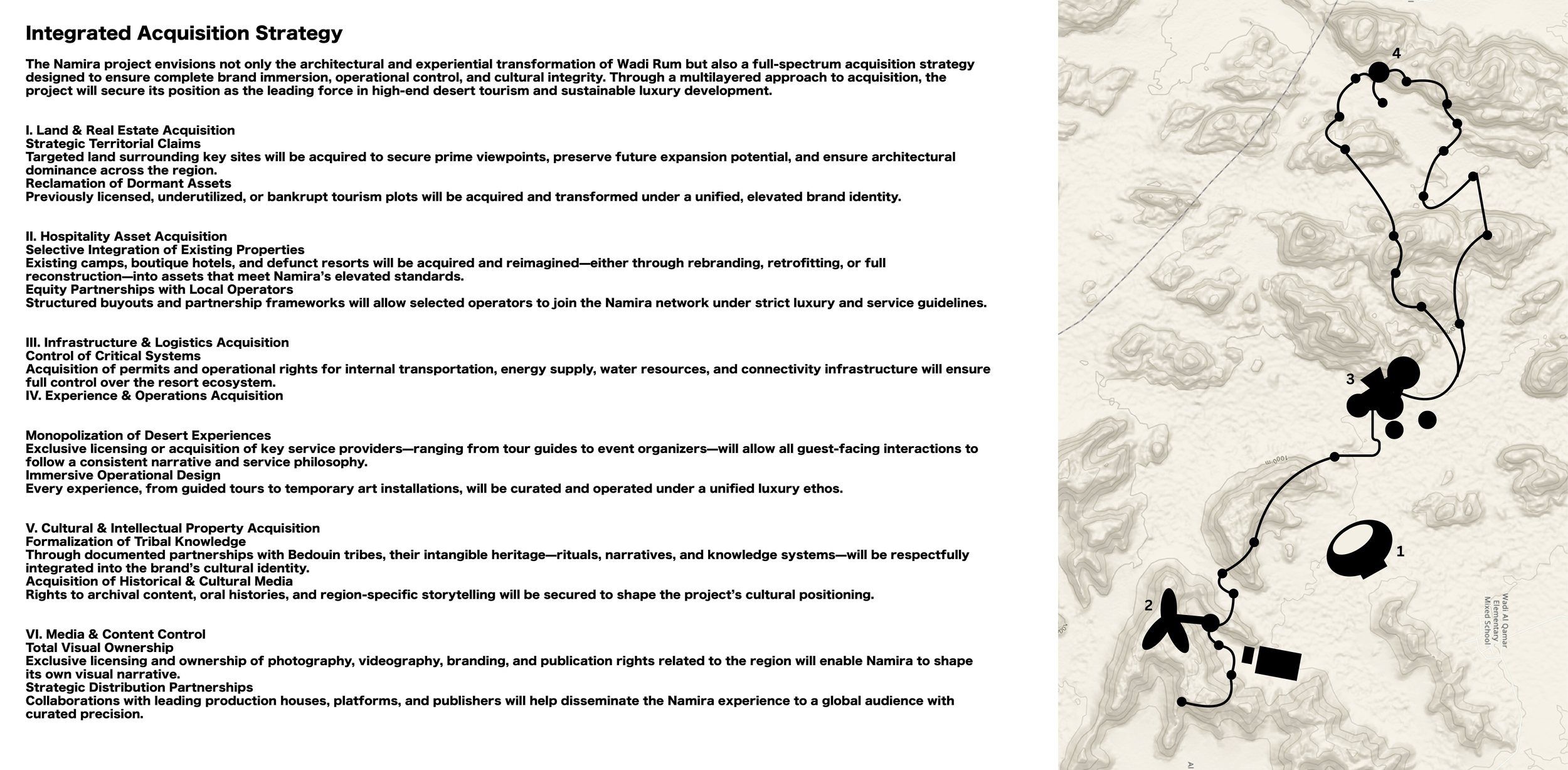

Namera is not one resort. It is a constellation of projects forming a branded cluster — an interconnected ecosystem of resorts, retreats, lounges, and cultural experiences.

• Each project has its own character and design language, but all belong to a single umbrella identity.

• The cluster is concentrated within a tight 5–6 minute radius, giving the impression of a private city-in-the-desert.

• Infrastructure, services, and even transportation are standardized under the Namera identity, reinforcing a sense of belonging to a destination rather than a collection of standalone properties.

• Guests, whether staying for $150 a night or $400 a night, participate in the same exclusive branded world.

In essence, Namera is a luxury ecosystem that challenges the scale of an entire city — but within a curated desert enclave.

Strategic Opportunity

• The Gap: Jordan lacks a luxury desert cluster. Wadi Rum has camps and isolated retreats, but no cohesive, branded destination.

• Comparables:

• AlUla (Saudi Arabia) – desert luxury at scale, but government-led and monolithic.

• Ayla (Aqaba) – a Red Sea project, but disconnected from desert heritage and reliant on artificial settings.

• Leverage: Namera sits in a triangle of global attractions — Petra, Wadi Rum, Aqaba — and transforms this geography into a synergized brand zone.

• Market Trend: Global tourism is shifting toward cultural luxury and experiential travel. Namera positions Jordan to capture this rising demand with first-mover advantage.

Differentiation & Brand Power

• Destination Brand, Not a Resort: Namera as a standalone name, not just a property.

• Unified Identity: From architecture to transportation to guest experience, the cluster speaks one language of design and service.

• Creative Edge: A program of events, cultural collaborations, and artistic activations keeps Namera dynamic and globally visible.

• Multi-Market Appeal: Ultra-luxury travelers, cultural explorers, wellness seekers, and lifestyle tourists all find tailored experiences within the same branded ecosystem.

• Integrated Cluster Model: Multiple properties in one zone create territorial dominance, exclusivity, and reputational control.

• Monopolization of the Desert Experience: Owning key plots across a radius enables control over pricing tiers, guest flow, and promotional leverage.

Strategic Benefits

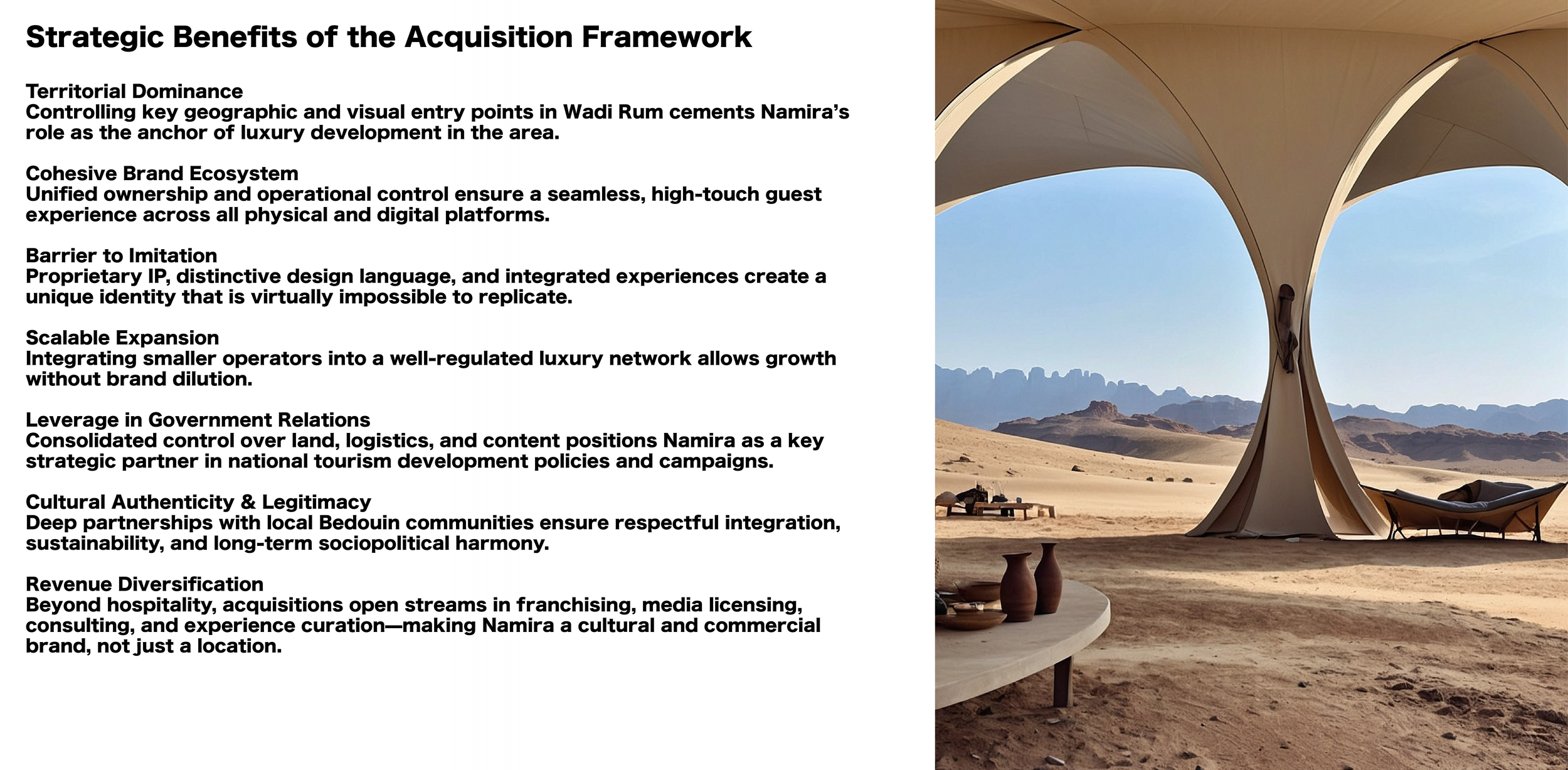

• Territorial dominance in a prime desert zone.

• Cohesive ecosystem difficult to imitate.

• Scalable expansion without dilution of identity.

• Stronger leverage in government relations.

• Diversified revenue streams across hospitality, events, and cultural programs.

• Long-term cultural legitimacy as the desert’s premier brand.

PHASE 01

PHASE 02

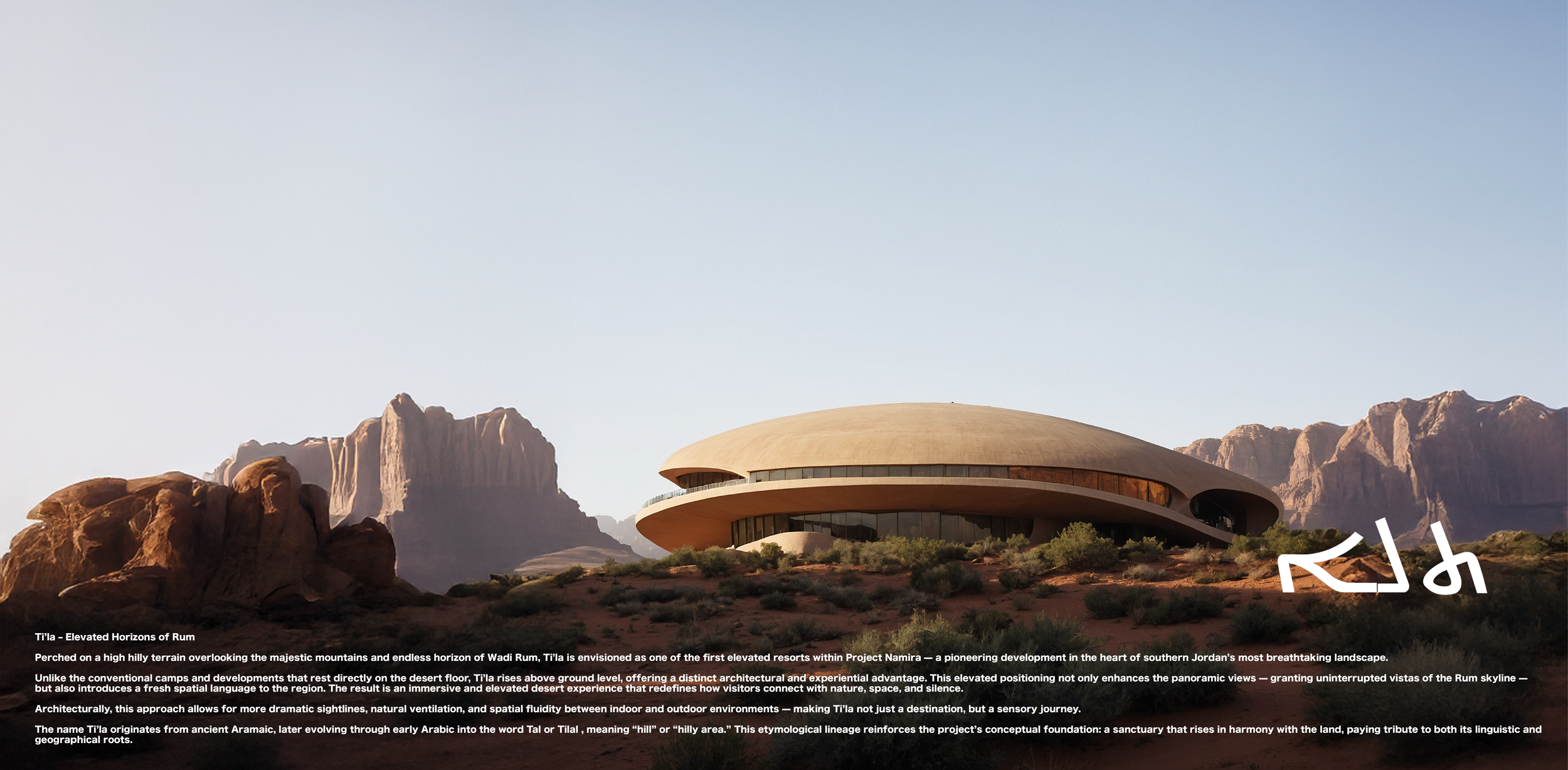

TI’LA

ORA

HAJEER

SAKA

MARSA

KAZZAN

IN DEVELOPMENT

IN DEVELOPMENT

Investor Value Proposition

A New Asset Class in the Middle East

Namera offers investors a first-mover entry into Jordan’s emerging luxury tourism infrastructure, combining real estate, cultural destination branding, and experiential development under a single cluster.

Unlike conventional resort projects, Namera is designed as an integrated economic platform that scales across multiple revenue sources, asset classes, and phases of growth.

1. Multi-Asset Equity, Not Single Property Exposure

Investors gain ownership within the Namera Cluster Holding Company, which controls a portfolio of assets: luxury resorts, wellness retreats, event venues, retail hubs, and cultural landmarks.

Each project contributes both individual revenue and cluster-level brand equity.

Result: diversified returns, lower risk, and participation in a rising ecosystem rather than a single resort.

2. First-Mover Advantage in an Untapped Market

Jordan remains a blue-ocean market for high-end desert and cultural tourism.

While neighboring countries are saturated with mega-projects, Namera represents one of the few privately led, investor-accessible opportunities in this segment.

Result: early investors capture territorial and brand dominance before competition materializes.

3. Rapid Land Value Appreciation

Through phased land acquisition across Zone A in Wadi Rum, investors benefit from both operational income and appreciating real estate value.

Namera’s early-stage parcels are strategically selected near major tourism corridors (Petra–Wadi Rum–Aqaba), where infrastructure development and visibility will multiply land valuation.

Nemira — Strategic Research & Development Dossier

A consolidated dossier containing strategic, regulatory, commercial, design and operational research to support development, due diligence and stakeholder engagement for Nemira’s Wadi Rum programme.

-

Short brief: Concise analysis of market demand, competitive benchmarking, and Nemira’s strategic differentiation versus regional peers (AlUla et al.), oriented to investment decision-making.

-

Short brief: Investor-focused summary of direct and indirect economic incentives, risk profile, fiscal/structural benefits and strategic advantages of investing in the southern Jordan corridor.

-

Short brief: Comprehensive checklist and procedural roadmap of permits, leases, public approvals and agency touchpoints required across Ministries, ASEZA, Petra authorities and UNESCO interfaces.

-

Short brief: Contract templates, governance models, governance board charters, sample DTL (Designated Tribal Liaison) agreement clauses, dispute resolution pathways and compliance checklist.

-

Short brief: Revenue and operational levers, sensitivity scenaria, capital requirement categories, funding waterfall options and investor return considerations (high-level only — detailed modelling post-site selection).

-

Short brief: Catalog of critical project risks (political, operational, reputational, environmental) with prioritized mitigations, escalation paths and incident playbooks.

-

Short brief: Evidence-based overview of local stakeholder mapping, tribal dynamics, trust levers and the recommended NSO/DTL engagement model with contractual controls and KPIs.

-

Short brief: Media & reputation playbooks, pre-approved statements, escalation matrix, and structured campaign timing to pre-empt and manage adverse public narratives.

-

Short brief: Cluster marketing framework for integrated promotion across Nemira assets — brand architecture, channel mix, PR partnerships, luxury trade outreach and editorial strategies.

-

Short brief: Sales channels, yield management approach, luxury travel advisor relationships, membership/loyalty options and white-glove direct booking mechanics.

-

Short brief: High-level masterplan principles, siting criteria, design constraints (heritage & environmental), building envelopes and phasing guidance for Wadi Rum terrain contexts.

-

Short brief: Product typologies, room-type hierarchy, illustrative unit footprints and spatial programming guidance for resorts, suites and nomadic lodges.

-

Short brief: Logo architecture, typography, colour systems, imagery style and curated moodboard / assets library for brand application across digital and physical touchpoints.

-

Short brief: Guest experience blueprints, service scripts, housekeeping & F&B SOPs, VIP protocols and accreditation standards for a luxury-level operation in remote conditions.

-

Short brief: Air/road/ground access options, helicopter/helipad considerations, Sherp/ATV scenarios, on-site mobility standards, baggage logistics and telemetry requirements

-

Short brief: Programming strategy for curated nightlife, concerts and cultural events, ticketing governance, community protocols and compliance checklist to minimize reputational risk.

-

Short brief: Water, energy and waste strategy, low-impact construction guidelines, biodiversity safeguards and measurable sustainability KPIs aligned to international best practice.

-

Short brief: Framework to embed Nabataean/Bedouin heritage across design, rituals and programming while safeguarding authenticity and preventing commodification.

-

Short brief: Workforce academy model, certification/training pathways, ALP (Accredited Local Partner) scheme and mechanisms for transparent local hiring & skills transfer.

-

Short brief: Recommended KPI set, data sources, reporting cadence and dashboard design for stakeholder transparency (safety, jobs, emissions, community funds).

-

Short brief: Curated archive of imagery, video footage, cited secondary research, press coverage and source links for investor reference and editorial use.

-

Short brief: Primary and secondary sources, citations, methodology notes and a list of required primary information still pending collection.

TILA

Take a minute to write an introduction that is short, sweet, and to the point. If you sell something, use this space to describe it in detail and tell us why we should make a purchase. Tap into your creativity. You’ve got this.

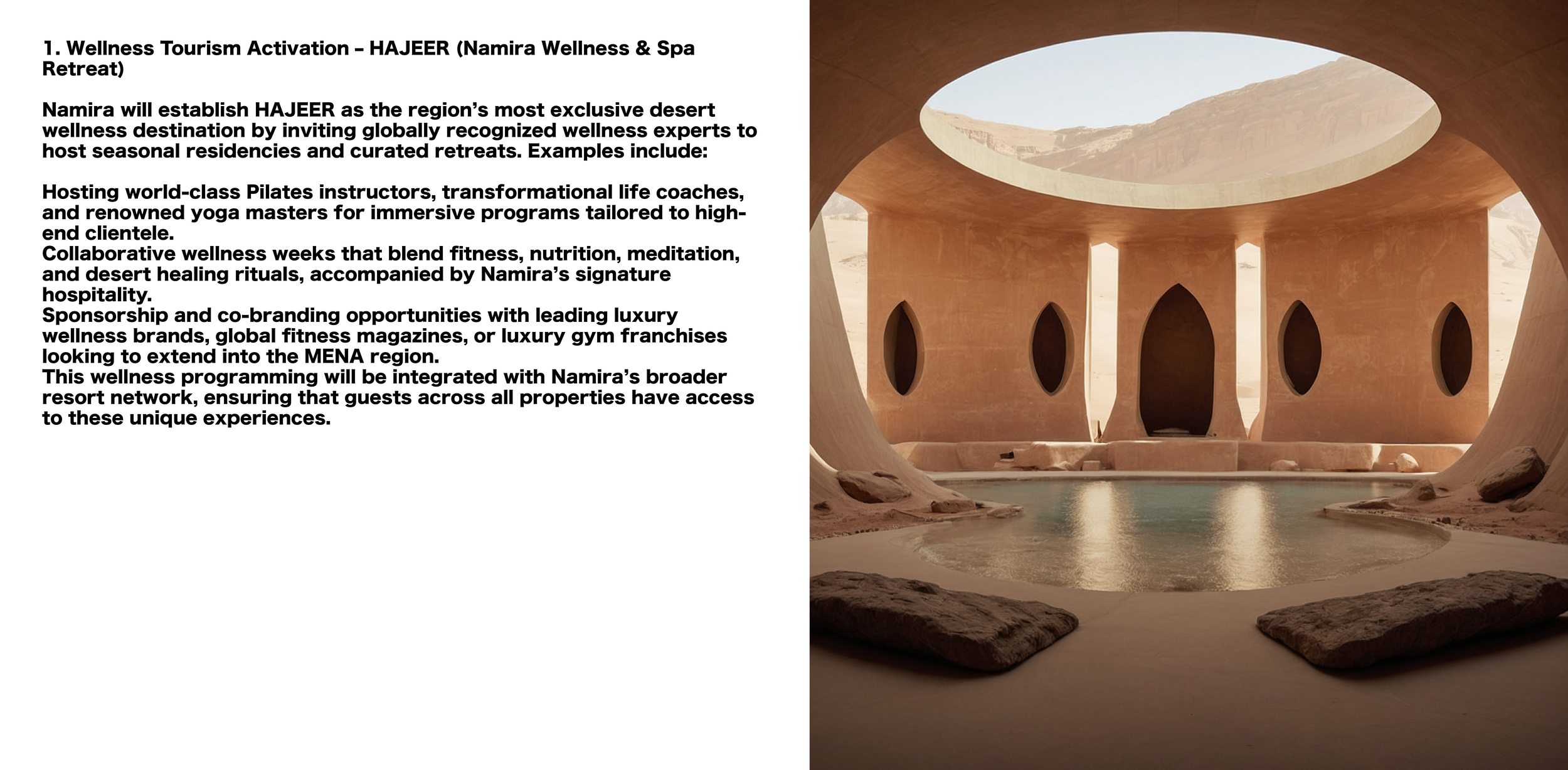

HAJEER

Take a minute to write an introduction that is short, sweet, and to the point. If you sell something, use this space to describe it in detail and tell us why we should make a purchase. Tap into your creativity. You’ve got this.

SAKA

Take a minute to write an introduction that is short, sweet, and to the point. If you sell something, use this space to describe it in detail and tell us why we should make a purchase. Tap into your creativity. You’ve got this.

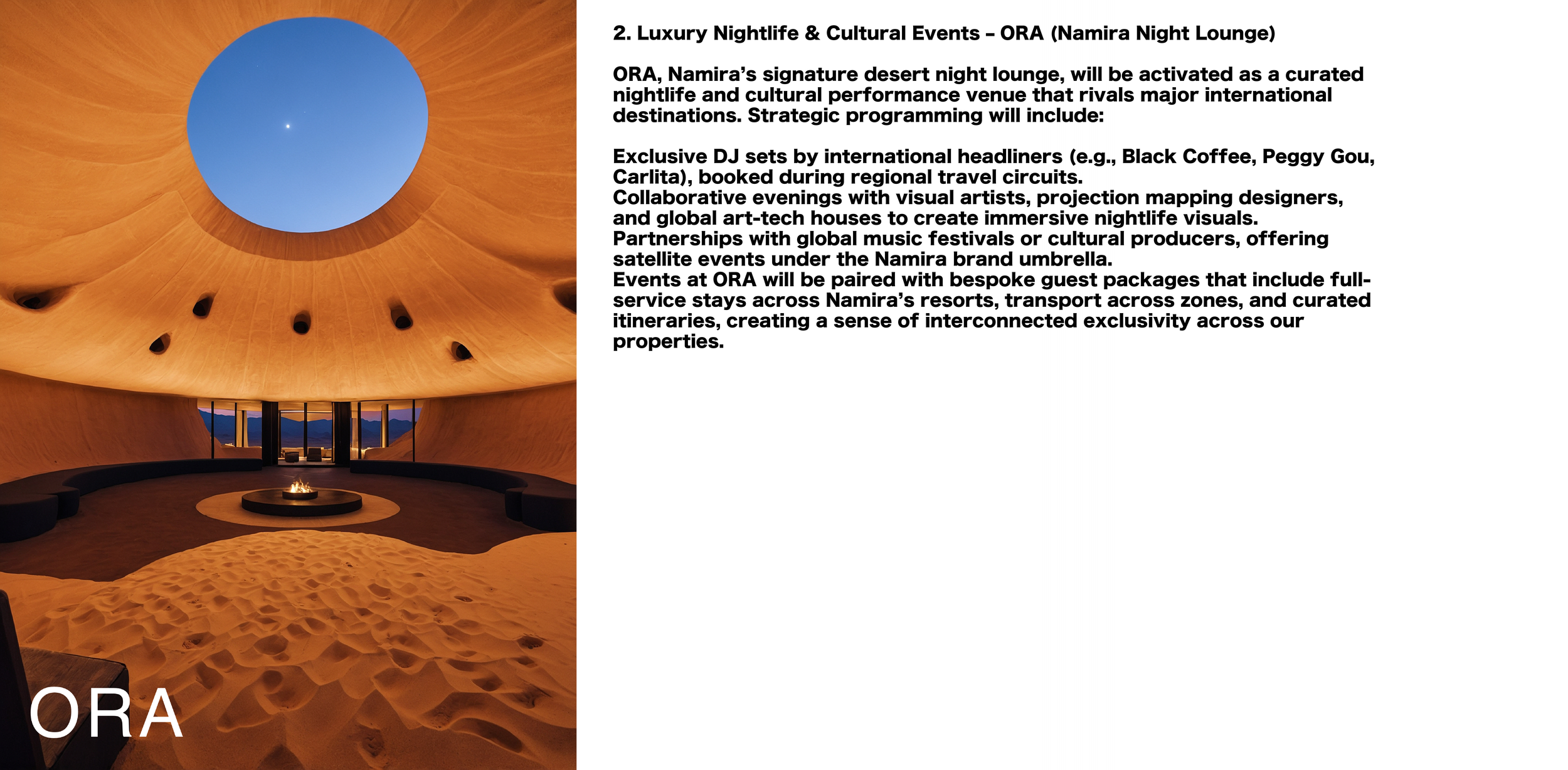

ORA

Take a minute to write an introduction that is short, sweet, and to the point. If you sell something, use this space to describe it in detail and tell us why we should make a purchase. Tap into your creativity. You’ve got this.